Today we are talking about biogas incentives and whether or not current policies on biogas incentives are right. Specifically, we're going to be focused on anaerobic digestion and what we think the policymakers could or should do to maximize its potential to increase investment in the sector.

Biogas is a very interesting product that is proving useful in improving sustainability across a number of sectors including energy, food production and waste management. However, biogas production is a complicated process involving a range of different technologies and it is rarely economical without some form of subsidy or support mechanism. To date, these subsidies have been based on the energy output of the biogas process, but biogas is a poor match with any particular energy vector and so the subsidies are often poorly designed.

In this webinar (see the video above or our unofficial transcription below), Angus Paxton, Antonio Michelon and Martti Surakka discuss the potential for biogas production and how it might be suitably incentivised to deliver decarbonisation and sustainability without costing the earth, its impact on decarbonisation and the opportunities for future investments across Europe.

Introductions – The Webinar Presenters

My name is Angus Paxton. I'm a Principal at Afry Management Consulting. I've been at Afry for over a decade and I've worked largely on gas topics. More recently I've been picking up hydrogen and biogas as well. I'm based in Oxford in the UK, and I'm very pleased to be introducing and presenting this webinar to you.

I will now let my colleagues introduce themselves; Antonio.

I am Antonio Michelon Director at Afry. I'm based in Milan one of my areas of expertise is methane recently also biomethane and investment analysis. So that's why I'm here.

I'm Martin Senior Consultant at Afry Management Consulting, based in Helsinki. For the last 15 years, of which for 13 years I've been dealing with different issues of renewable energy including biogas and biomethane. So I've been concentrating quite a bit on the technical and process issues and feasibility of biogas production.

Now back to Angus. Okay. Thanks, Antonio. Thanks, Marty. The slide pack and webinar will also be posted on the Afry website alongside the other 25 or so webinars that we've done recently.

Let us start.

Why is biogas important what the potential outlook for biogas is over the next decade or so to have a look at:

- how it is now, and

- how it could be incentivized as an investment, and

- see what some of the investment opportunities might be in a few jurisdictions.

Why Biogas?

Biogas production using the Anaerobic digestion process is a really useful system.

It allows us to do a few things:

- processing our wastes which allows us to avoid landfill and incineration of food waste and sewage sludge

- it allows us to avoid stockpiling and then spreading muck in a farming environment which allows us to reduce the emissions of agriculture

- it also produces energy which is no doubt why many of you are here now. (If you've heard of it from an energy perspective it allows us either to produce that as on-site heat and maybe some power generation that could be used on-site or exported to the grid. Potentially the gas could be put into the gas distribution system and used more generally.

- it can also be used for producing some pretty good quality fertilizers and soil conditioners.

The 2 Major Benefits of Biogas

The two major benefits of biogas really are about:

- Nutrient recycling and waste processing and about the “circular economy” that allows us to reduce the carbon footprint of farming.

- For the energy sector: Using biogas within the energy sector helps us to decarbonize heat and power. It can reduce the cost of decarbonization long term

But Biogas is Really Complicated…

Is the technology of biogas production really complicated?

Yes, and No!

It is definitely more complicated if you compare it with the wind power or solar cells or solar power

A biogas plant has many more so-called “moving parts”. It requires a lot more components and an AD Plant requires constant attention.

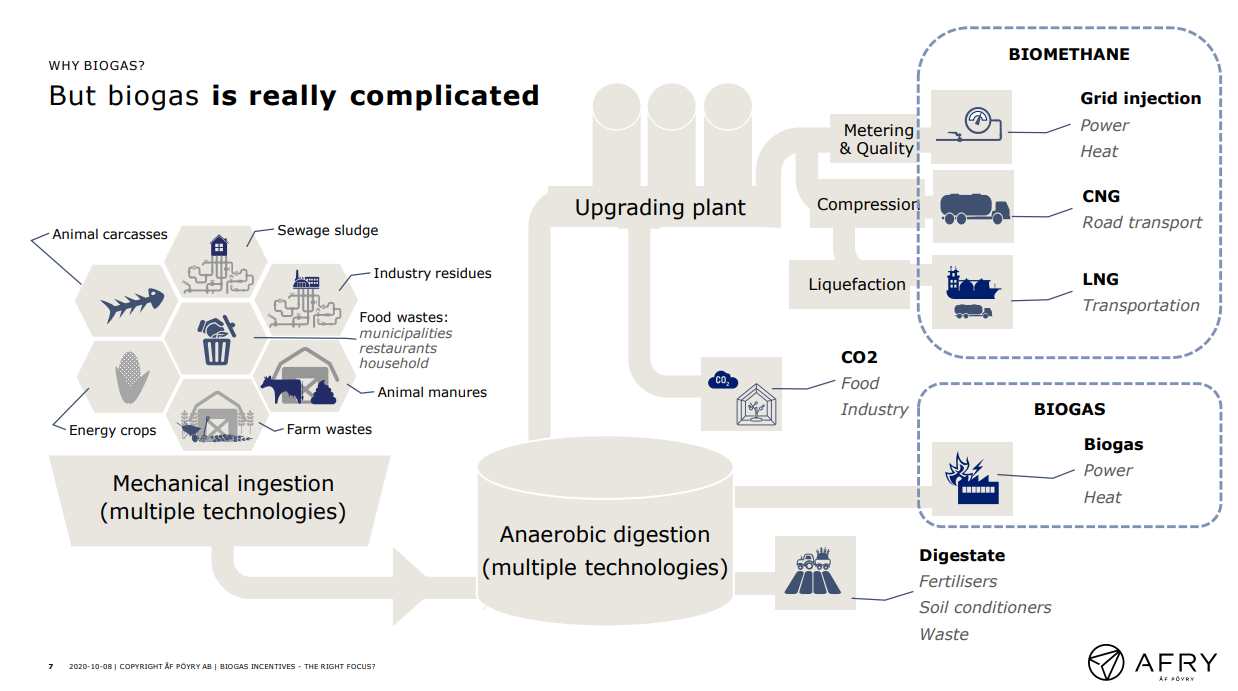

If we start from the beginning so that you can see this process flow diagram which is quite common for any biogas plant:

It is immediately apparent that there are plenty of different digester feed materials.

Almost anything organic can be fed to the biogas digester and used as a raw material for biogas and digestate production. These start with animal carcasses, sewage industry sludge residues, to using food wastes and municipal waste.

All of these fractions require sorting and feeding. Pre-treatment technologies need to be provided quite often which are designed to make the biogas yield as high as possible, but alternatively, the pre-treatment can be provided just for the AD plant operator to be able to feed the feedstock material to the biogas process in a form that is suitable for the chosen process technology.

Ther is a lot more to this, but you get the idea. Anaerobic digestion contains multiple technologies, multiple processes, and it really just forms the heart of the whole system.

Wet and Dry Digestion

There are even two divergent mainstreams of the AD technology. These are:

- wet and

- dry digestion.

“Wet” meaning that the dry matter content in a feedstock is from about 5% or 6%t up to 12% – 13%. Meaning that it's a pumpable slurry and it will be moved as a liquid by pumps and mixers.

The other process type is a dry AD technology where the dry matter content is from 20% to 50% and sometimes even more. Based on its name, we are treating the feedstock in solid form and the devices around the digester are then designed and made for handling the solid material.

When we finally have our feed inside the biogas digester a proportion of it will be converted to biogas which contains about 50 to 75 % of the produced biogas as methane and the rest being mainly carbon dioxide and some traces. Traces include, for example, hydrogen, oxygen, ammonia and so on.

Digestate: What it is and Its Benefits

The other stream coming out from the biogas digester is known as the “digestate“.

Inside the digester, the feedstock is decomposed by the microbiological process. A natural process of decomposition containing hundreds of different kinds of bacterias converting it step by step to methane, plus some other products – the digestate.

This part of the digester is the one requiring quite a bit of attention, of course. The process itself once started is pretty robust but to get the best out of it and for food waste, it requires some fine-tuning and some additives need to be used and other things like that.

Special attention has to be paid to maintain the right nutrient balance in the digester. For food-waste-only AD plants, special attention has to be paid to adding trace elements or “micronutrients” like cobalt zinc, nickel, etc regularly.

Getting the Trace Elements Right

But if those same trace elements are present in concentrations which are too high that will also bring trouble to the biogas process. As an example from the past, we often give the case study of one plant the plant owner that got quite a good load of cocoa into their hands to digest. They started feeding that to the digester. At first, it looked as if the gas production had increased and so did biogas quality improves as well. But then all the sudden there was a downturn in biogas production.

The reason for that was found to be that although cocoa is a good source of zinc etc. when used a little bit in the biogas process and it actually boosts and improves the biogas process. But when there is too much of it, it starts inhibiting the process and gas production drops.

It's a little bit like drinking alcohol for us. A little bit can be good, but if you take too much… You know the consequences!

Digestate in Liquid and Fibre Forms

In the digestate, 95% of the input comes out in a liquid and a solid-state. This two-state output is an excellent organic fertilizer in its best cases it can be used on fields, and if the quality doesn't quite match with the fertilizers required, it can still be used as a soil conditioner in construction when landscaping parks lawns etc. Of course, there are some cases where the digestate, unfortunately, has to be treated as waste.

The second product is the biogas which has gotten the most of the publicity, while the digestate seems to be often forgotten. The biogas can be directly used for producing power or heat or both on-site or it can be piped to an upgrading plant where the carbon dioxide impurities and so on are removed. With the result that the gas is upgraded (purified) to match the grid quality or other quality requirements set by the potential offtake.

Upgrading “Biogas” to More Valuable “Biomethane”

After passing the biogas through the upgrading plant we have biomethane. It's not anymore just “biogas”. Biomethane contains from 90% to about 99% methane. Mostly carbon dioxide is what has been removed and in principle, that is also a valuable commodity with a good value.

There are many ways to utilize biomethane. Examples of uses are Natural Gas grid injection and in the form of CNC (Compressed Natural Gas) mainly go into use as fuel for road transport vehicles. CNC allows transportation of the gas for longer distances.

Is that Enough Complexity for You?

That's briefly enough to show you that it's a process which is quite complicated! There is plenty more which we haven't even mentioned!

Even more, complexity will follow when we start talking about the subsidies.

So I'm moving you back to Angus.

Taking a brief look at some of the economics behind biogas and some of the financial flows.

The Economics Behind Food Waste Biogas Plant Operation

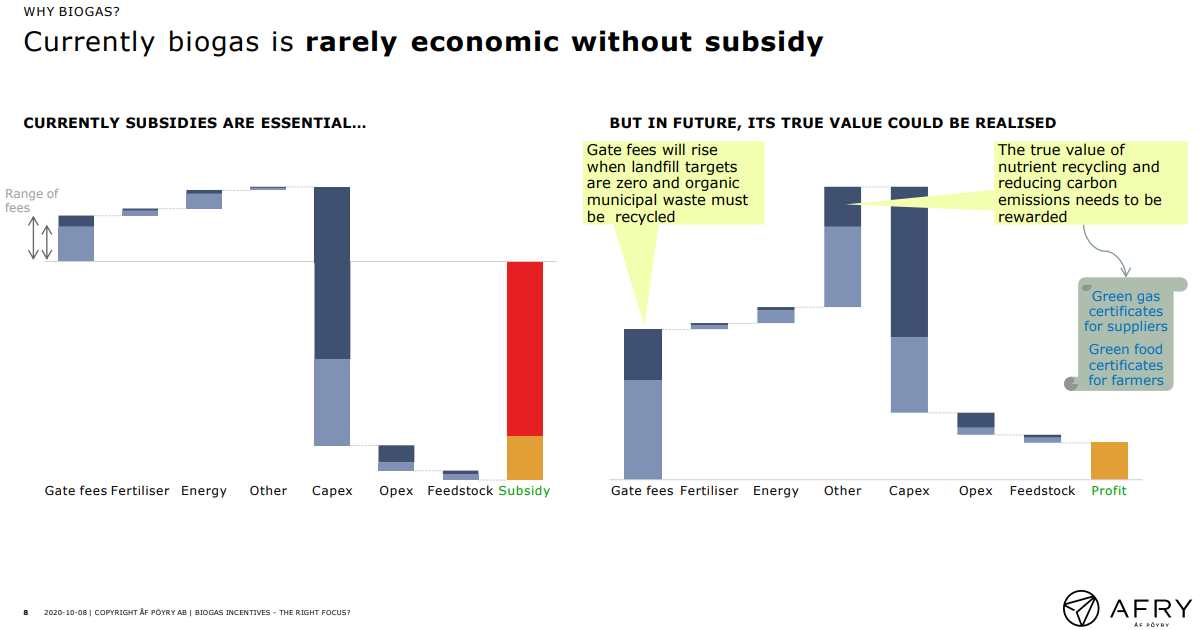

We have here some charts. They're just stylistic charts to represent the points that I want to get across, but the chart here shows effectively a typical pattern for current biogas operation.

Biogas plant operators are paid gate fees. These are payments received by the biogas producer because they're taking on-board somebody else's waste. They're paid for receiving that waste and from it they may produce:

- fertilizer and sell the fertilizer

- they will produce energy [for their own use] and

- receive revenue for the energy and

- then there may be other revenues.

They can obtain income from things like:

- green gas certificates currently, [and

- historically in the UK, there were other subsidies since ceased. Most existing AD plants are still grandfathered in on those and for some years yet will still receive those payments].

Under the current subsidy (2020) these are dwarfed by the CAPEX required (see the chart above).

The capital funding requirement is really so significant that you know we're not going to be building biogas without some decent subsidy.

Assuming that there will be adequate subsidy mechanisms to ensure continued growth and investment in the sector long-term isn't particularly financially sensible. But, nevertheless, there is some scope for optimism.

In the future to value to release the true value of biogas we might need to see increases in gate fees which might be driven by things like:

- changing landfill targets down to zero and

- requiring that all food waste municipal waste must be recycled that would increase the gate fees, plus

- there are other potential avenues for ensuring that more value is given to the biogas producer for example through green gas certificates.

- beyond that, there is scope for additional assistance which can be envisaged, such as assistance from the public who may seek out green food.

Green Food Certificates

If we were to have a supplier obligation for example for “green food certificates” the concept is that consumers will want to consume their food knowing that's been produced sustainably. This could also help pay for biogas plants.

The Need for Subsidy Mechanisms

So the message there is that biogas is currently usually uneconomic without a subsidy mechanism [in addition to those available in 2020]. That's why the industry needs subsidy mechanisms.

The Outlook for Biogas in 2021 and Beyond

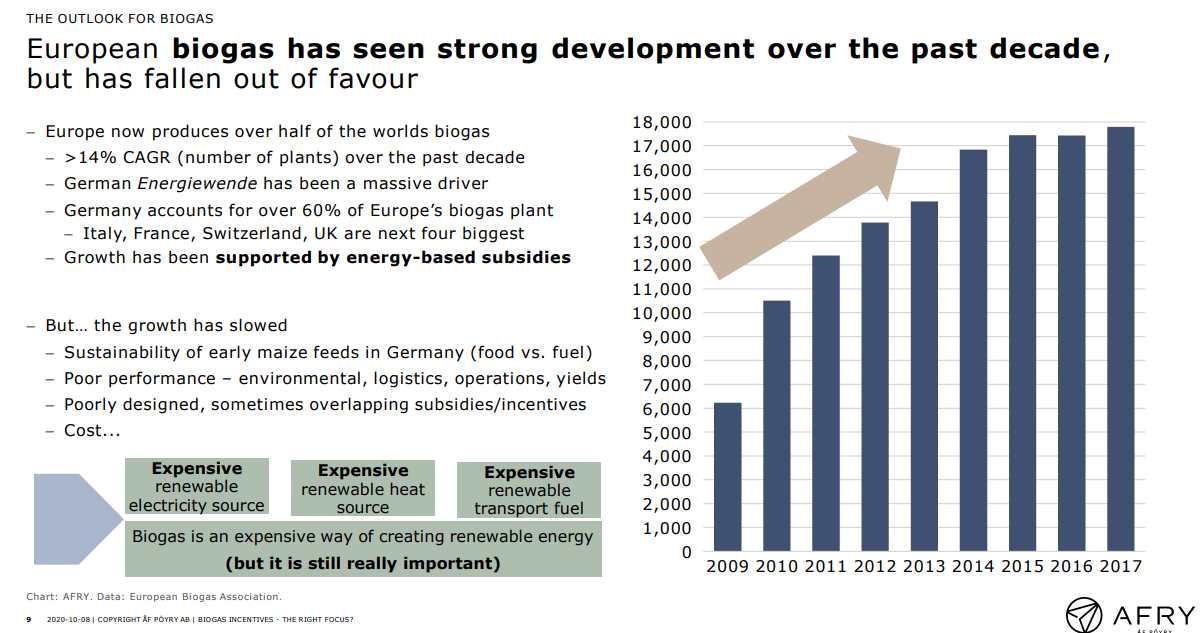

Now let's move on to think about the outlook for biogas. Looking briefly at the history the chart below is taken from data from the European Biogas Association. It shows the number of biogas facilities that have been built over the last decade or so and Europe is now producing over half the world's biogas and we've had a massive growth rate.

Over that last decade, that's been largely driven by the subsidy mechanisms in the German Market and the quest for renewable energy. That has driven an awful lot of biogas development in Germany. Italy France Switzerland and the UK are also fairly large, but not large compared to Germany.

All of this growth has been supported by energy-based subsidies so biogas producers are paid a subsidy for the amount of energy that they're producing. The growth has slowed in more recent times. That's because of a number of observations that things like the sustainability of some of the early German biogas plants haven't been brilliant.

Own-Goals Inflicted on the Reputation of Biogas

We also walk into a food versus fuel debate there. A significant part of the land in Germany is now being used to grow energy crops for anaerobic digestion facilities. Biogas plants have also suffered from some poor performance. This being poor performance on:

- environmental standards,

- logistics getting feedstocks into the facilities.

- Operation of the plants hasn't been particularly reliable and yields haven't necessarily been as high as promised

- and, this all points back to the fact that these plants are very complex things and they need some careful management.

Also, the subsidy mechanisms that we've had so far have sometimes been overlapping and sometimes there's been double subsidies. All of this [has resulted in] policymakers reviewing biogas see it as it's an expensive source of renewable electricity.

Disadvantages of Biogas

Biogas doesn't compete very well with wind and solar, on price. It's an expensive source of renewable heat. It doesn't really compete very well with the likes of ground source heat pumps, for example, and it's also expensive as a renewable transport fuel.

As a renewable transport fuel it doesn't compete with the likes of biodiesel very well, so the underlying message there is that biogas is an expensive way of creating renewable energy.

That is not really to paraphrase Obi Kenobi! Biogas [incentivisation] is not really the change that the gas industry is looking for!

Escaping the Importance of Biogas Would be to Deny Reality!

But, biogas is still really important though and it's really important not because of the energy that it's producing, but because of the sustainability it can provide around;

- processing waste,

- soil conditioning,

- good land management.

[Despite the warts which we have described] you might be surprised that many commentators have high expectations for biogas into the future.

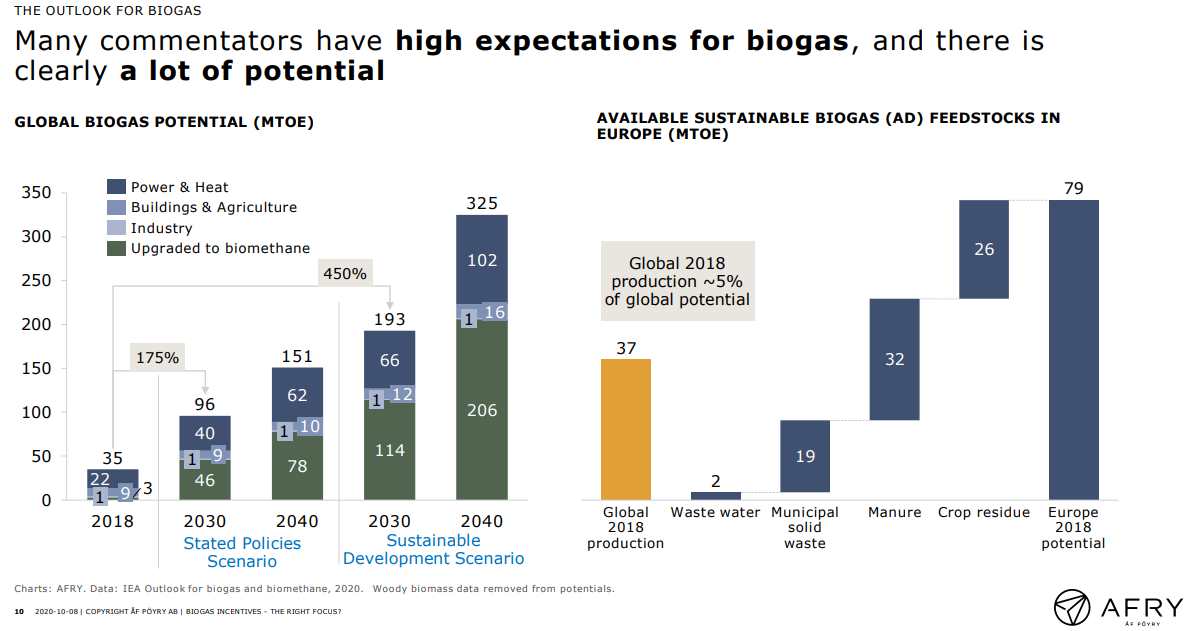

There is clearly a lot of potential in biogas. This is demonstrated by looking at a couple of charts (below) derived from IEA data. The chart on the left shows IEA projections of global biogas production.

Clearly, as the market leader for biogas, Europe may not grow as much [proportionately] as other regions, and Asia in particular. But there are stated national policies and expectations in Europe that biogas (in particular biomethane) output will grow substantially over the next decade. Plus, the recent announcement of 55% greenhouse gas reduction by 2030 instead of 40% reduction will only serve to increase this growth potential in Europe.

You can see that over the next decade in a couple of IEA scenarios they are showing 175% or 450% growth in global biogas potential [by 2030]. That's a huge growth so the chart above is very telling.

There's still a lot of room to grow biogas using sustainable sources, so this chart is also showing the sustainable biogas feedstocks tonnages available in Europe. That's the blue area, the orange bar on the left is showing the global sustainable available biogas production. Globally we're only using about five per cent of our global potential now.

Clearly, we're using more than that in Europe, but Europe's total is still double the amount of global production. Just in terms of potential, that 5% is really significant. That's a really stark figure.

I know that we could look at a similar metric for wind or solar, but if we don't use all our wind and solar potential it isn't a problem. The important fact here is that the vast majority of the sustainable biogas feedstocks are difficult to handle and environmentally-damaging waste products. [Not using them produces a double whammy of environmental damage.]

The potential is also really quite significant. I think the potential is also potentially even larger than this. It's even larger than the IEA are suggesting because there's additional potential from emergent technologies. At this point in time, they do present some difficulties, they add to the complexity of biogas, in some ways.

That's because you also need to start thinking when you're thinking about seaweed, that you're thinking about salt content in your biological process. They may be too expensive for mass deployment.

But I think the message is clear that there is a huge potential for biogas.

Moving on to think about how that might be incentivized the current European policy on biogas and biomethane isn't well joined up, and it's led to us having many different schemes across different countries. That means that we've got different incentives in different countries and different practices. The result is different impacts and different outcomes, and we're learning different lessons in different jurisdictions.

We're not necessarily transferring the lessons learnt from one jurisdiction to another. There's a lot of complexity in the subsidy mechanisms and some of them are designed better than others.

[Discussion of existing subsidies and related issues for consideration, not included here. Watch the video for those!]

Looking Into the Future of Biogas Plant Subsidies

3 Examples of Anaerobic Digestion Facility Support Schemes in Use

Examples here are one in the UK and the other one in Italy. The third is in Denmark.

UK Green Gas Support Scheme

This is the proposed new UK incentive scheme [now confirmed by BEIS] called the Green Gas Support Scheme in the UK. This will be a continuation coming after an existing support scheme which is the Renewable Heating Incentive (RHI) ends. The RHI was targeted at the heating sector. This new scheme will be a scheme starting in 2021 and will initially last for five years and it will include a payment of the tariff that you see below from 4.9 to 5.5 GBP per kilowatt-hour.

That means in Europe megawatt-hour 54 to 60 GBP for the first 60 Gigawatt-hour of production which basically means six million cubic metres per year after that and up to the achievement of a 100 Gigawatt-hours.

You would in as an investor earn a lower tariff from 36 to 41 Euro per megawatt per hour and after the 100 Gigawatt-hours, you would receive a lower target.

Now the there are a couple of interesting elements of this of the scheme one is that an investor could in a way arbitrage between two systems one is the Green Gas Support Scheme (GGSS), and the other one is the Renewable Transport Fuel Certificate (RTFC) which includes a certificate that can be traded currently.

Depending on market dynamics that's from 23 to 60 Euro per megawatt-hour and this is important because it allows the investor to somehow mitigate the risk of being anchored to one single support system. As we said before, there is a risk element which in this case is a regulatory risk. The element the tariff would be given for 15 years and the tariff would also be lowered once the biomethane volume is accumulated.

This is talking from a national level perspective and not from a planned perspective, so once an investor got a tariff you will get that 30 for 15 years no matter what. It's a risk for investor planning that they don't really hit the expected tariff because in the meantime the regulator has lowered that because they have achieved enough incentivized volume.

So this is basically a way to control the total cost of this incentive scheme. What is also interesting is that the scheme is targeted at achieving a mix of feedstock which is considered to be the best mix which you can see below including food waste at 50%.

In parallel to that, a different department of the UK government is working on, a Bill on Food Waste reduction. The current situation in the UK regarding food waste is pretty fragmented. You have a collection in one region or village and maybe you don't have it in the other council area, so that bill will be aimed to bring order and harmonization to the UK.

This will first of all impact on food waste availability. In principle, it would produce a much higher food waste availability. Gate fees would rise.

Italian Biogas Incentive Scheme

The Italian incentive scheme is a scheme totally geared toward the use of gas in the transport sector. There are a couple of background elements in this scheme. The first one is that Italy is a bit below the achievement of their target for the use of renewable energy in the transport sector. This is why this is designed exactly for that achievement.

The other element is that in Italy you already have a developed gas transport infrastructure. In Italy, we do have more than a million gas-fuelled cars. So the way the scheme works is that if you produce biomethane you get a certificate and you can sell that certificate in the market.

Currently, there is no market for that certificate. You get a certificate every 10 Giga calories produced. If you produce advanced biomethane which means producing biomethane from a predefined set of feedstocks, including for example a food waste but also sludge including manure, for example. First of all, they double the certificate you can get and you receive a fixed price for every certificate which is a 365 Euro now. If you do the math that is 65 Euro per megawatt which is very similar to what you will get in the UK. The difference is that get that for 10 years and not 15 years.

The Danish Biogas Support System

The next slide shows the Danish incentive system in this a producer would get 56 Euro megawatt-hour for 20 years. The regulators have been zooming over the same kind of level so 50 60 Euro megawatt-hour. In addition to that, you get a certificate that can be traded across the border with Germany and Sweden, although the downside is that currently, the market is not really that developed and not that transparent. Let's say the market value of the certificate is between 10 and 20 Euro per Megawatt-hour as you can see from the chart below most of the certificates are being traded in Sweden. There's a reason for that as the use of biomethane in Sweden enjoys a fiscal discount.

Swedish traders are willing to pay a higher price for the certificate because then they can get this economic benefit. The Danish system envisages a quota of energy crop below 12 and also the Italian system somehow limits the use of energy crops.

Typically, for example for corn (maize), that has been widely used for biogas production. Now let me make a note here! Use of energy crops is not necessarily bad. You do have crops that in fact help to manage agriculture. For example, they help to fix the nitrogen in the soil, or through routine, they help stabilize in the soil. So not all energy crops are bad.

Another interesting thing here is that in Denmark dairy industries they have to pay a carbon tax. But if they use milk coming from farmers that contribute the manure to biogas plants then that is considered a zero-carbon product. Hence they gain a tax discount, therefore the Danish system is kind of more articulated in terms of the benefit that you have as an investor. It is not only in energy production. The tariff you receive is also from another part of the value chain.

This system will be renewed in the next years.

Summing Up

Back to you Angus. Okay, thanks, Antonio. I think we're coming towards the end of our time. But before we go I just want to give a quick sum up.

Marty told us that biogas is really useful, but that biogas is also really complicated.

I then talked about the requirement for support mechanisms to be able to realize a lot of the potential that's out there, but those support mechanisms are going to be difficult to get right.

Antonio told us about the investment side of things, the assets a small aggregation may provide.

Some opportunities have been discussed by walking us through some of the existing subsidy schemes in some countries.

Thank you very much for listening and we're going to move to some Q and A now. [Q&A session not included – we suggest you watch the video version embedded above.]

Thank you, everybody. Bye! It's been a pleasure and reach out to us. Thank you.

This article is an unofficial transcription of the YouTube video embedded at the start of this page. For the full slide set go to afry.com here.