Anaerobic Digestion Plants UK (AD Plants UK or Anaerobic Digesters UK)

The number of anaerobic digestion plants in the UK, (anaerobic digestion plants UK) has been growing since the current UK interest in building these facilities began at the start of this century.

Now in the summer of 2021, there are 685 operational AD Plants (including sludge digesters at Wastewater Treatment Plants) according to ADBA.

Most UK AD plants have been commissioned since 2013 when the number of Anaerobic Digestion Plants in the UK hit 100 for the first time.

That was seen as a big achievement and was reported extensively in the trade press as being a turning point.

The point at which 100 UK operational biogas plants was reached was seen as a milestone. It indicated that a fledgling UK biogas industry had become established.

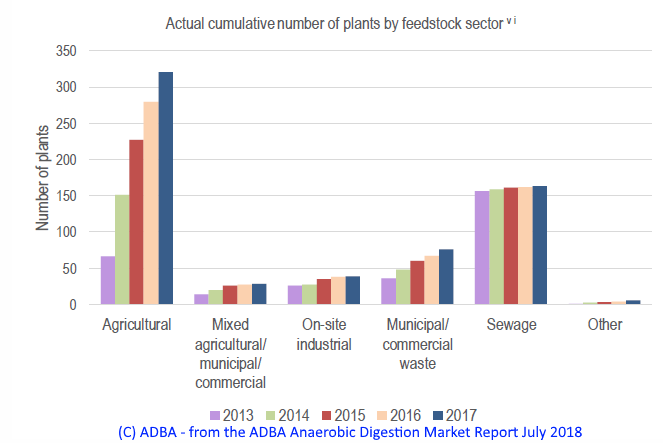

The best period for growth in the capacity of UK AD plants occurred in the period 2013 to 2017. Since 2017 the industry has seen a slowdown.

However, it is thought that the period 2021 to 2022 will see this trend reversed.

Where Can I Find Data on UK AD Plants in Operation?

A few years ago WRAP provided a UK AD Plant map which it was keeping up to date with an invitation to all active AD Plant operators to enter details of their own plants. That has disappeared (Summer 2021) and The NNFCC website at first appears to have taken on the responsibility for providing these details here. On that page it states “Click here to open the map in a new window” but public access was not available when we tried.

Although, as a UK government-funded organisation it would be expected that WRAP would maintain the most up to date data on UK AD Plants. That does not now appear to be true.

AD Industry Trade Association ADBA does still maintain a record of UK AD Plant numbers and locations, but this is also no longer available to the public. Their anaerobic digestion plant list and the map showing each plant's location would appear to be the most authoritative source for UK anaerobic digestion plants. But can only be viewed by their members.

rom a Clearfleau AD video and is included in compliance with the CC0 licence provided with their YouTube/Vimeo published video.

Scroll down further on this page because we also provide historic lists of the early biogas plants as a snapshot of the early days of Anaerobic Digestion plant operation in the UK.

Back in 2016 things were going well for anaerobic digestion in the UK. The following is our article as updated in 2016:

The Number of Anaerobic Digestion Plants Operating in the UK in 2016?

Currently (Autumn 2017) the latest WRAP update is 254 anaerobic digestion plants (March 2016), but that figure for operational anaerobic digesters in the UK, is now over a year out of date.

During 2016 there was reported to have been a surge in anaerobic digestion plant construction. Existing UK government subsidy approvals would have been lost if a number of these plants had not been completed before the UK ROCS subsidy was discontinued.

The Anaerobic Digestion and Bioresources Association (ADBA) reported that 100 biogas plants were built in 2016. If that rate of completion of anaerobic digestion plants (in the UK) had been maintained an additional 150 plants would have been completed. Not only completed but also commissioned in the intervening period to the end of September 2017.

Looking at the arithmetic: 254, plus 150 only accounts for about 400 anaerobic digestion plants UK-wide, so there may be some ADBA-listed plants that have ceased to operate. Making that an underestimate of the actual plant numbers completed in the period.

However, the ADBA anaerobic digesters UK list must be considered the most authoritative source.

The list is maintained by the UK association which represents the biogas plant operators themselves.

How many ad plants are there in the UK?

On the basis of their data, the UK has now broken the 500 AD plant mark now, so the answer to the question: “How many ad plants are there in the UK” is:

- There are now 640 recorded active anaerobic digestion plants in the UK (October 2018).

- One year ago there were 540 (September 2017) [See our blog post about this here.]

- The number of recorded UK AD plants in the available lists has doubled since early 2016

- The listed number has only risen by 38 over the last year. This suggests that the UK AD industry output has fallen in the last 12 months since subsidy reductions.

The fall in UK AD plant growth in 2017 was disappointing.

However, the future growth rate for anaerobic digestion plants in the UK is now thought to be recovering. One reason for this is that the UK government has made a recent announcement on a future subsidy. This is intended to help the industry. It will be part of the Department for Transport's (DfT's) response to its consultation on the Renewable Transport Fuel Obligation (RTFO) as we have previously reported in our weekly newsletter.

How did the country get to the point of having over 600 UK anaerobic digestion plants?

Scroll down further and you will see our historic information on UK biogas plant numbers over the last decade.

Municipal, Commercial, and Farm-Based AD Plant Number Reaches 100 – in 2013

The following is our version of the list which appeared in 2013, on the Biogas Info website maps page, when the number of UK plants had just risen to a magic 100 for the first time!

List of the First 100 Anaerobic Digestion Plants in the UK

| 1 | AC Shropshire Ltd (Waste Feedstock; |

| 2 | Adnams Brewery (Waste Feedstock) |

| 3 | Agri-Food and Biosciences Institute (AFBI) (Farm Feedstock only) |

| 4 | All Waste Services Ltd. Llangadog (Burdens) (Waste Feedstock) |

| 5 | Anaerobic Digestion DevelopmenCentre (ADDC) (Waste Feedstock) |

| 6 | APS Salads (Waste Feedstock) |

| 7 | Avonmouth Organic Food Waste Treatment Plant (GENeco. Wessex WaterEnterprises) (Waste |

| 8 | Feedstock) Sited at a Sewage Treatment Works |

| 9 | Ballyrashane Co-op (Farm Feedstock only) |

| 10 | Bank Farm (Farm Feedstock only) |

| 11 | Battle Farm (Agrivert Ltd) (Waste Feedstock) |

| 12 | BH Energy (Farm Feedstock only) |

| 13 | Biffa – Cannock (Waste Feedstock) |

| 14 | Binn Farm (TEG Biogas; (Waste Feedstock) |

| 15 | Blakes Abattoir (Future Biogas Ltd) (Farm Feedstock only) |

| 16 | Bore Hill Farm Biodigester (Waste Feedstock) |

| 17 | Branston Ltd. (Waste Feedstock) |

| 18 | Bruichladdich Distillery (Waste Feedstock) |

| 19 | Bulcote Farm (Severn Trent Water) (Farm Feedstock only) |

| 20 | Buttermilk Hall Farm (Hallwick Ltd) (Farm Feedstock only) |

| 21 | BV Dairy (Waste Feedstock) Housing Estate |

| 22 | Cannington Cold Stores Ltd. (“Waste Feedstock) |

| 23 | Carr Farm (Farmgen) (Farm Feedstock only) |

| 24 | Channel Farm (Farm Feedstock only) |

| 25 | CJ Parish & Sons (Farm Feedstock only) |

| 26 | Clayton Hall Farm (Waste Feedstock) |

| 27 | Cockle Park (Farm Feedstock only) |

| 28 | Copys Green Farm (Farm Feedstock only) |

| 29 | Corsock Farm (Farm Feedstock only) |

| 30 | Crouchland Fsrm (Farm Feedstock only) |

| 31 | Dailuaine Distillery (Diageo (Scotland; Ltd) (Waste Feedstock) |

| 32 | Deerdykes Composting & Organics Recycling Facility (Waste Feedstock) |

| 33 | Didcot Sewage Works (Biomethane Injection) |

| 34 | Dryholme Farm (Farmgen) (Farm Feedstock only) |

| 35 | Farington Waste Recovery Park (Waste Feedstock) |

| 36 | Fernbrook Bio Ltd. (Waste Feedstock) |

| 37 | Gask Farm (John Rennie & Sons Farmers Ltd.) (Waste Feedstock) |

| 38 | Girvan Distilliery (Waste Feedstock) |

| 39 | GreaYnys Farm (Ynergy Ltd.) (Farm Feedstock only) |

| 40 | Green Tye (Guy & Wright) (Waste Feedstock) |

| 41 | GWE Biogas (Waste Feedstock) |

| 42 | Harlescott WWTW, Shrewsbury – Sewage sludge – Close to houses in Harlescott |

| 43 | Harper Adams (Energy) Ltd. (Waste Feedstock) |

| 44 | Hill Farm (Farm Feedstock only) |

| 45 | HMP Guys Marsh Prison (Burdens) (Waste Feedstock) |

| 46 | Holsworthy (Waste Feedstock) |

| 47 | Homeleaze Farm (H & Q Farming) (Farm Feedstock only) |

| 48 | Insource Energy – Rogerstone Park (Waste Feedstock) ~ food waste – Light Industrial Park? |

| 49 | JMW Farms Ltd. (Farm Feedstock only) |

| 50 | Knockrivoch Farm (Farm Feedstock only) |

| 51 | Langage Farm (Waste Feedstock} |

| 52 | Linstock Castle Farm (G Wannop & Son) (Farm Feedstock only) |

| 53 | Local Generation Ltd. (Waste Feedstock) |

| 54 | Lodge Farm Digester (Waste Feedstock) |

| 55 | Lowbrook Farm (Farm Feedstock only) |

| 56 | Lower Reule Bioenergy (Waste Feedstock) |

| 57 | Mauri Products Ltd. (Waste Feedstock) |

| 58 | McCain Foods (Waste Feedstock) |

| 59 | Melbury Bioenergy Ltd. (Farm Feedstock only) |

| 60 | Melrose Farm (Northern Crop Driers Ltd) (Farm Feedstock only) |

| 61 | Miekle Laught Farm (Farm Feedstock only) |

| 62 | Much Fawley Farm (Farm Feedstock only) |

| 63 | North British Distillery Co. (NBD) (Waste Feedstock) |

| 64 | Northwick Estate (Waste Feedstock) |

| 65 | Orchard House Foods (Waste Feedstock) |

| 66 | Organic Power (Waste Feedstock) |

| 67 | Oxford Renewable Energy Ltd. (Waste Feedstock) – Didcot close to residential property |

| 68 | PAS (Grantham; Ltd (Waste Feedstock) |

| 69 | Rainbarrow Farm (JV Energen) (Biomethane Injection) |

| 70 | Reaseheath College (Farm Feedstock only) |

| 71 | ReFood (Waste Feedstock) – Urban Doncaster |

| 72 | Roseisle Speyside Whisky Distillery (Waste Feedstock) |

| 73 | Scottish 3nd Southern Energy (SSE) Barkip Biogas (Waste Feedstock) |

| 74 | Setter Farm (Barfoots of Botley) (Waste Feedstock) |

| 75 | Shanks (Orgworld) (Waste Feedstock) |

| 76 | Sharps Brewery Ltd (Molson Coors) (Waste Feedstock) |

| 77 | Smerrill Generating Station (Kemble Farms) (Farm Feedstock only) |

| 78 | Sorbie Farm (Farm Feedstock only) |

| 79 | South Shropshire Biodigester (Biocycle) (Waste Feedstock) |

| 80 | Spring Farm (OArnold Renewacles Ltd) (Farm Feedstock only) |

| 81 | Staples Vegetables (Farm Feedstock only) |

| 82 | Stoke Bardolph (Severn Trent Water) (Maize – Duggan) |

| 83 | Stuchcury Manor Farm (Marston St. Lawrence Estate) (Farm Feedstock only) |

| 84 | Swancote Farm (Waste Feedstock) – Urban/Semi Rural |

| 85 | Symonds Farm (Waste Feedstock) |

| 86 | The Green (Farm Feedstock only) |

| 87 | The Ryes (Farm Feedstock only) |

| 88 | Thornton Waste Technology Park (Waste Feedstock) – Light industrial park? |

| 89 | Trinity Hall Farm (H3llwick Ltd) (Farm Feedstock only) |

| 90 | Tuquoy. Westray (Farm Feedstock only) |

| 91 | Twinwoods (Waste Feedstock) |

| 92 | University of Southampton Science Park (Waste Feedstock) – Light industrial park? |

| 93 | Viridor Waste Management Ltd. – Newton Heath (Waste Feedstock) |

| 94 | Walford & North Shropshire College Farm (Farm Feedstock only) |

| 95 | Wanlip (Waste Feedstock) |

| 96 | Wateroeach (Waste Feedstock) |

| 97 | West Stowell Farm (Farm Feedstock only) |

| 98 | Western Isles Integrated Waste Management Facility – Comhairle nan Eilean Siar (Waste Feedstock) |

| 99 | Westwoods Plant (Waste Feedstock) |

| 100 | Windover Farm (Farm Feedstock only) |

Anaerobic Digestion Plants UK – Plants in January 2011

Anaerobic Digestion Plants UK – Plants in January 2011

The following may not be on the list of 100 above, or are featured for their interesting features:

AD Plants UK (in England and Wales)

The following may not be on the list of the first 100 AD Plants above, and are included for their historic interest:

- Wanlip Leicester as part of a Biffa MRF. Operated by Severn Trent.

Water (BIFFA). Accepts biodegradable Municipal Waste. 1.5 MW potential power output. Operational large-scale plant Approx. 35,000 tpa. - Woking Council, Surrey – Preliminary pre-contract discussions.

- South Shropshire Council, DEFRA Waste Technologies Demonstrator Project. This partly DEFRA-funded Waste TechnologyDemonstrator Plant, in Ludlow, Shropshire has been mothballed.

- Longstock, Hampshire – The technology provider is Bioplex Ltd. Feedstock is agricultural residues and animal waste slurries. The throughput is about 1,500 tpa.

- Milton Ernest, Bedfordshire – Bioge technology plant operated by Bedfordia Farms Ltd. Accepts Food waste (ABP 2+3) Operational plant with a reported throughput of 42,000 tpa

- Rushden (Westwood), Northamptonshire CC, Biogen Food waste1.5 MW, Under development 41,000 tpa

- Wareham, Dorset – In-vessel composting Operator SITA. Feed will be Bio-waste. this plant is under development

- South East London – Operator would be Veolia – Food waste. thought to be at the feasibility study stage.

- Doncaster, South Yorkshire – Initial stages.

- Honiton – Otter Rotters Ltd

- Elgin – Integrated Bio-Gen Ltd – early stages

- Bank Farm – Operated by Clive Pugh (Private Ind.) 790 m3 Operational plant

- Eye Airfield, Eye, Suffolk – 1.05 MW. Not yet built, but fully consented

- Dimmer – Wyvern Waste Services Ltd, 3 MW. – Not yet built, but fully consented

- Lowe Farm – 0.5 MW – Not yet built, but fully consented

- Longstock, Hampshire – Operator Bioplex Ltd. Technology Bioplex Demo Plant 0.0075 MW. Currently operating

- Horsington, Somerset – The technology provider was Organic Power and so is Operator. this is a demo plant

- Cambridge Research Park/ Waterbeach near Cambridge – Operator Summerleaze, and technology also by Summerleaze.

- Swang Farm, near Bridgwater, Somerset. Operator Tim Roe (MD) Cannington Cold Stores

- Sandford, Whitchurch, Shropshire; Lower College Poultry Farm

- Greater Manchester Waste Disposal Authority, North Manchester plant – Enpure Ltd – Greater Manchester

- Greater Manchester, Bredbury Parkway; plant by Enpure Ltd -MSW – Under development

- Leicestershire CC (Estates Dept) – Feasibility study for a central AD Plant

- Stockport, Manchester – Design by Greenfinch Ltd. Operation to be by Fairfield Ltd.

- Update October 2008

- GR Lancashire UR-3R process- 2 plants under construction Leyland and Thornton

- Biffa/ Clarke, West Sussex, Hasse process, 1 facility at preferred bidder

- SRM/NEWS Norfolk CC Contract A AMBT with Dranco/OWS AD process near Final Closure

- Oaktech, Glendale /Falkirk, Arrowbio process 1 facility under construction Thanks to Rob W

- Coca-Cola's manufacturing facility in Warrington, UK, incorporates an anaerobic wastewater treatment facility, dating from the early 1990s.

- BV Dairy Shaftesbury, Dorset will generate more than 75% of the site’s electricity consumption with a new Anaerobic Digestion (AD) system. The high-rate liquid digester has been designed and built by Clearfleau. EnerG is supplying the equipment to convert the biogas into energy.

- Dalkia is delivering its energy generation and carbon efficiency capabilities to Dairy Crest by designing and installing a biomass energy centre at the Davidstow Creamery in Cornwall.

- In April 2008 Kemble Farms completed the Smerrill Generating Station. Located beside the Smerrill Dairy, it produces Electricity and Heat from the cow's slurry and energy crops.

- As announced on 13 December 2010, TEG was developing a new anaerobic digestion (“AD”) and in-vessel composting (“IVC”) plant in Dagenham, East London, which is expected to be in operation in 2012. The Mixed Waste was planned to be processed at the Dagenham plant from 2012.

We hope this information about the anaerobic digestion plants UK-wide, was useful to you. Please give us your feedback in the comments box below.

Russell. We agreed with you, so this page has been comprehensibly updated now!

Hi there.

Brits still have a way to go to compete with the Germans who have thousands of these.

Sal

What does the future of small scale (sub 100kW) micro AD plants look like for the UK market?

I hear differing views , hesitance to commit due to uncertaincy around the post Brexit picture.

Being a simple man, taking the simple view, we will still have land, we will still need milk and it’s associated products, with control of our own internal markets, it may suffer a “blip” but it will recover.

Does a small scale AD plant for a dairy farmer therefore still make for a sound financial investment for the future of individual farmers??

Doing a bit of research – so would be grateful for views/comments – eitherway,

Thank You

Terry. I agree with you that the need for fuel/fertiliser etc., is not going to cease just because of Brexit. In fact, in the event that the pound falls the result will surely be that home-sourced energy from, for example, AD will become relatively cheaper than importing it, and in great demand!

However, I think that the hesitancy I sense myself in the UK market, is to do with the lack of government action on the Renewable Heat Incentive (RHI), and Renewable Transport Fuels Obligation

The government has been saying the right thing about supporting AD ever since 2010, but the reality has been rather different. One of the most damaging things has been subsidy reductions done at short notice.

Some AD plants were in construction and about to be at the point of applying for ROCs for example, last year (up until ROCs was stopped for new Ad plants in April of this year), and some were rumoured to be committed to construction budgets at higher levels of subsidy than they could get, when subsidies were progressively reduced and the scheme was closed earlier this year.

For at least the last 10 years, perhaps longer, there has been good technical logic behind giving higher subsidies to the smaller farms to install AD, but the government (and Labour before them pre-2010) went for subsidising larger farms, and the waste industry (who were also able to provide larger plants).

Presumably that was simply due to the fact that they thought that while lowering subsidies they would get a better take-up for large projects, due to economy of scale. In other words, they would get more bang for their buck from the larger farms going into AD, and their targets would be met for renewables more easily than dealing with many more smaller projects on the smaller farms.

Now, this time round, the larger AD plants should hardly need much subsidy to be confident of being profitable, so I have been hoping that at last the government will turn their attention to encouraging smaller AD plants.

I sense a change in government with Michael Gove as Minister now in charge we may see a sea-change in policy. Not so much in what they SAY they will do, but they will start to take action, and action speaks so much louder than words!

After so many years without a proper statement of strategy, the “Clean Growth Strategy” was published last week. I personally suspect that some sort of a policy log-jam may now have been cleared, but as far as I am aware, nothing so far gives a hint on whether the reinstated RHI when it comes out, (although being apparently more generous) will help the small farmer/ small AD plants.

The forthcoming RTFO is less likely to help small AD, but again there is a remote chance that it could give at least some preferential treatment to require buyers to source from small ad plants.

So, to summarise. Yes, I agree that on the face of it, there isn’t any tangible reason to hold back on UK small AD investment based on a good business case, and based on the current economic environment. But, I would be hesitant due to the wish not to discover when the RHI reinstatement is published that if my project had been planned/ designed to be say just 15% bigger, or slightly differently configured it would have met a requirement, which would have allowed me to meet a subsidy threshold!

I hope that makes sense.

I found this page and I find it really useful on bio gas facility stats in the UK. it helped – was useful to know how many of these plants have been made. Video is good. I hope to give something back and help others like you helped me.

Hi, Thanks for some really interesting information.

I’m looking into small-scale AD’s how small is small? for animal sanctuaries MSc Dissertation.

Do you record very small operations?

Any help would be much appreciated.

Derek – I came across just the right pdf for you to download recently at the Gent University Biorefine website. Click here to download it. They list over 60 small-scale biogas plants – some which they call “pocket biogas plants”. Also, San Diego Zoo has a biogas plant and that sounds similar to an animal sanctuary to me! Detroit Zoo has a biogas plant, and I think also Toronto Zoo has one.

Enormously helpful, your blog never fails to impress me.

I’ve found myself back at this website a number of times this year.

I want to encourage the author to continue the great writing

Don’t forget, we do have Paypal set up for those that wish to buy our microdigester (micro anaerobic digester) plans from our website.

Have a Merry Christmas!

Guys. Just great info here. BUT, this is the way to make green energy. We will never be able to make ENOUGH, unless we also SAVE ENERGY. Consider using eco-friendly lighting. There are many types of bulbs, compact fluorescent bulbs, which are affordable alternatives to typical incandescent bulbs. They provide an adequate amount of light while using a fraction of the energy necessary for regular bulbs. Keep GROUNDED guys. Go green – but also SAVE ENERGY.

What is the number of UK AD plants now. I need for my project. You show the numbers for last September (2017) only.

Hello there, You’ve done an excellent job. I will definitely Tweet this and personally recommend

to my biogas friends. I’m confident they will be benefited from this website.

Great writing/website. Please tell me. Are there yet any UK Goose Farm anaerobic digestion plants?

I don’t know of any goose farm biogas plants, but there is at least one which is purely for chicken farm waste.

Britain is full of b*%%shit. Don’t trust. Propoganda anerobic digestion propoganda.

Which are these? Anaerobic digesters is a weird name. Just call them biogas plants. KISS. Keep it stupid simple.

I think the point here is that in Scotland they are not too far in the future implementing zero waste to landfill. As I understand it they will ban all organic matter being tipped in Scottish landfills. Considering the state of our environment, we should applaud this. It comes very high up the list of all efforts to stop storing up long-term problems for future generations. So, these digesters are NOT OPTIONAL because this is where they will have to send the organic waste!

In terms of future trends, is the UK more likely use biogas for heat and electricity (CHP) or favour upgrading to biomethane?

Kenny. Upgrading to biomethane is definitely the favourite use of biogas, not least because the subsidy for electricity production is no longer available to new AD plants, but for the moment (for the right AD plants) the Renewable Heat Incentive (RHI) is still available and can be used for CHP with biomethane production.

Hi biogasman, glad to have a chance to read this blog and your comments, we are in biogas upgrading, compare to common membrane technology which often use in HK, our unique technology is stripper-absorber, and use amine to absorbs and cleans the gas.

As your mentioned, UK is growing in the biogas sector, as well Ireland, we have been trying to introduce our technology to UK clients, however the outcomes are rather less interests, not the matter of price, technology wise we are def advance and with quiet some presentable plants in Scandinavian, both small and large scale. I was wondering if you can give some advices, and perhaps helpful channels to understand better?

Have you considered attending some of the Anaerobic Digestion and Biogas Exhibitions in the UK, such as the ADBA exhibition and conference? You would be able to attend presentations, or could give a presentation yourselves about your technology. There are also always biogas construction contractors at these exhibitions who you can talk to and see whether they would like to offer your technology to their clients.

The industry in the UK being still quite small works a lot on the personal recommendations of the established biogas contractors. These contractors, particularly in the agricultural sector are turnkey design and build contractors. I think that you no doubt have a winning product, so I recommend that you attend UK exhibitions and make it your strategy to sell your stripper-absorber to the already successful design and build contractors. If you get them to use your technology in one, or more, of their new plants you will be getting your foot in the door I think. Have you thought of joining the trade association ABDA to develop UK company relationships?