As the UK intensifies its efforts to decarbonise road transport, the significance of the Renewable Transport Fuel Obligation (RTFO) and its associated RTFO Certificate (RTFC) procedure cannot be understated.

The biomethane industry, specifically, has found itself at the epicentre of this transformative wave, with RTFCs serving as a pivotal driver. A driver which along with fuel economy and sustainability benefits of biomethane (compressed and sold as renewable LNG) has raised the popularity of biomethane as a Road Transport Fuel for heavy goods vehicles to new heights year on year for over 5 years.

In this guide, we delve deep into the intricacies of RTFO Biomethane Prices, offering insights into RTFCs and the UK's biogas price per kWh.

Key Takeaways

- Biomethane production is crucial for the UK's ambitions to decarbonise road transport.

- RTFO and RTFCs play an essential role in incentivising the transition to renewable energy in the transport sector.

- Understanding RTFC market prices and tracking fluctuations can yield significant benefits for biomethane producers.

- The bio-fuels market's volatility presents challenges and opportunities for AD plant operators.

Table of Contents

Understanding the Renewable Transport Fuel Obligation (RTFO)

The RTFO is the UK government's primary tool to foster the adoption of renewable energy within the road transport sector. To receive the RTFO incentive payment, each batch of fuel dispatched to the fuel purchaser must possess an associated RTFO Certificate (RTFC).

Why Biomethane?

As the UK government seeks to reduce crop-based diesel bio-fuel production, biomethane emerges as a viable alternative to diesel fuel. Produced from biogas, biomethane is the only proven technology that can scale rapidly enough to meet the UK's renewable energy goals for transportation. Its role is thus indispensable in aiding the government in fulfilling its commitments to climate change reduction.

Definitions

1. RTFCs, or Renewable Transport Fuel Certificates

These are digital certificates that attest to the use of renewable fuel. In contrast to wastes and non-agricultural residues, which are double-awarded and receive two RTFCs per litre.kg of delivered renewable fuel, RTFCs are issued per litre/kg of liquid or gaseous renewable fuel.

2. Who Picks up the Bill for the Renewable Transport Fuel Obligation (RTFO)?

The UK legal requirement requires that fuel suppliers who deliver more than 450,000 liters/kg of gasoline to the UK must also deliver a portion of renewable fuel. The Renewable Transport Fuel Obligation Order of 2007 implements these.

Deciphering the RTFO Certificate (RTFC)

The RTFC signifies the price, in pence, of one single certificate.

Given the tradeable nature of these certificates, their prices are susceptible to fluctuations based on demand and supply dynamics.

The Biomethane Pricing Challenge

To make use of the ability of biomethane producers that compress their pure methane (natural gas equivalent gas) output biogas plant operators need to obtain up to date RTFO prices and trending information and choose to sell at the best prices.

Producers aiming to leverage RTFCs must ensure their sales contracts reflect the independent RTFC market prices.

By doing so, they can guarantee they're consistently selling at the prevailing market rate, even as it changes.

UK RTFC Price Trends Since 2018

RTFC price trends since 2018:

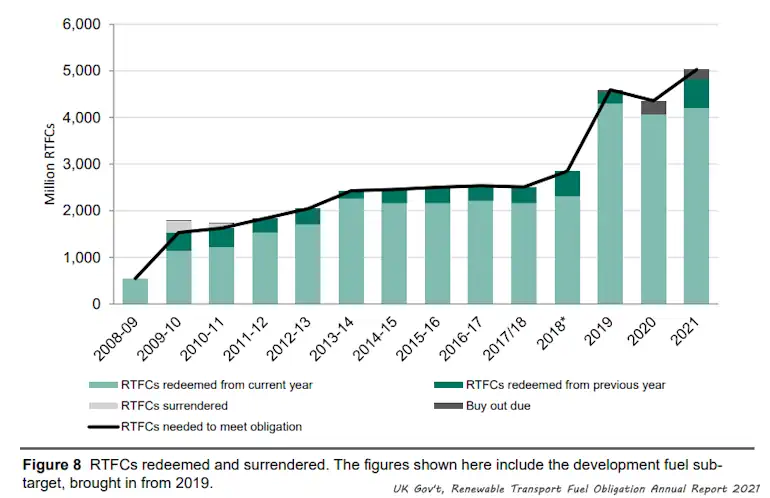

The chart above shows how RTFO uptake has risen over the years to 2021 and subsequently.

Energy Census has been publishing market price information since 2018 in their weekly (subscriber only) [RE]fuel report. These reports are essential reading to biomethane producers in the coming years. Read on to find out why that is, and how important it will become over the coming years.

Archive Energy Census Press Release January 2018:

Developments in the Biomethane Bio-fuel Market

It is no secret that the UK government is committed to ambitious targets for decarbonising road transport, while simultaneously reducing crop based diesel bio-fuel production. It has to be able to show rapid increases in renewable energy use in transport, to have any hope in maintaining credibility for its pledges for climate change reduction.

Biomethane producers are in a very strong position to help the government here, because they hold the key to government compliance. If the government has not realised it yet, it soon will.

The only proven technology capable of delivering sufficient energy, quickly enough, to come close to meeting these targets is biomethane from biogas. Nothing else has the tried and tested technology which can attract the necessary investment. Only biomethane purified from biogas can deliver on this.

The Role of the UK's RTFO Incentive in Delivering the Renewable Energy Needed for Road Transport Decarbonisation

The government has a long-standing, but rather blunt instrument to encourage the use of renewable energy in road transport. It's called the RTFO.

RTFO stands for Renewable Transport Fuel Obligation, and for any fuel to be paid the “RTFO incentive payment”, an associated “RTFO Certificate” must be available for each batch of fuel sent to the fuel purchaser.

The UK government hopes that AD Plant Owners will increasingly sell their output as compressed biomethane (CNG) (also known as RNG – Renewable Natural Gas) to the road transport fuel market. It makes very good sense for this to happen, both as one of the most energy efficient uses of biogas, and has other benefits in, for example minimising wasteful transmission losses in alternative uses. So, all those who favour climate change reduction and the decarbonisation of industry should support this, and thus the RTFO incentive scheme (RTFO) needs to work. But will it work?

Biomethane producers have plenty of other ways to sell their product, other than into the bio-fuels market for a good RTFO Biomethane Price. For, example many will already have installed injection equipment to supply their biomethane into the natural gas grid.

They would only logically choose to sell into a more volatile market if they know enough about prices to be confident that while selling into that market their risk of loss, will be handsomely rewarded in larger payments over a period of time.

How AD Plant Operators Can Sell Into the Bio-fuels Market and Make the RTFO Work for Them

The bio-fuels market has always been volatile, and will be likely to be even less stable with the increased use of bio-fuels. The AD plant operator selling into the market will have to cope with both a varying fuel price per unit of energy, and changes in prices of the certificates.

The certificates are trade-able and prices for these are likely to get even more volatile.

Many will simply not be willing to take-on these risks and will seek out alternative private buyers for their energy who will pay guaranteed RTFO Biomethane prices for long contract periods, and ignore the potential benefits of the premium RTFO Certificated fuel payment.

However, as in so many other markets, selling energy as a commodity will always be a balance of risk of volatility against price stability, where those that understand the market and are willing to accept more risk will over a prolonged period win-out handsomely.

However, as in so many other markets, selling energy as a commodity will always be a balance of risk of volatility against price stability, where those that understand the market and are willing to accept more risk will over a prolonged period win-out handsomely.

The wise biomethane producers will be those that are continually updating themselves on the current market prices for this commodity, which will vary according to the underlying price of methane.

The RTFC is the price, in pence, of one single certificate. As these certificates can be traded, and demand can rise and fall at various times, and the price of the certificates fluctuates.

Producers of biomethane who are able to claim the RTFCs would do well to link their sales contracts to the independent RTFC market prices [RE]fuel provides, so that they are making sure they are always selling at the market price, even when that price changes over time.

This is where, in the future, the RTFO Biomethane Price information provided by [RE]fuel will be invaluable to the biomethane industry.

A Few Pointers to Why Selling RTF Certified Biomethane May Become a very Profitable Option

There are a number of pointers which we have listed below which suggest that prices paid for biomethane may rise substantially due to supply-and-demand pressures, meaning that all biomethane producers would do well to keep a close-eye on RTFC market prices for the updated RTFO Biomethane Price:

- Biomethane is rewarded 1.9 RTFCs per kg (3.8RTFCs if derived from waste) under the RTFO, which puts an obligation on all major petrol and diesel fuel suppliers to blend 4.75% renewable fuel. If they fail to meet this target, they can purchase RTFCs or pay a buy-out price of 30 ppl.

- The target is going to ramp up quickly, hitting 9.75% by 2020, placing significant increased demand for biofuels.

- Blending restrictions will limit ethanol in petrol blending; waste biodiesel availability and crop cap could limit supply options for diesel – demand for ‘alternative’ fuels (or simply RTFCs) could therefore be high

- RTFCs have historically traded at around 12pp certificate, though have increased to above 20 pp certificate of late (see REfuel report) – the increased target can be expected to increase the certificate price further

- Biomethane derived from waste could therefore receive upwards of 5 pence per kWh (3.8RTFCs at 20p = 76ppkg; 76ppkg divided by 13.89 kWh per kg = 5.472ppkWh) – due to the buy-out price, the very maximum that could ever be achieved would be 8.2ppkWh from trading of RTFCs

The spreads that [RE]fuel are publishing in their current RTFO Biomethane Price reports (RTFC-RHI) show the difference in pence per kwh and pence per litre between what an AD plant would receive for their gas if they were to supply into the transport sector vs the heating sector – ie, at current prices, they would get twice as much per unit of gas sold if they supply into transport.

RTFO Biomethane Price – Service Conclusion

The government has indicated in its RTFO updates this autumn, that it will be seeking to ensure that biomethane producers find it worthwhile financially to sell their gas into the bio-fuel market.

However, the AD industry currently has little knowledge of the biofuel market RTFO Biomethane Price, within a market which is dominated by bio-diesel producers. That's where the new start-up company [RE]fuel has stepped in with its bio-fuel market price reports.

As biomethane plants come on-stream in the UK, with energy to sell for the best price, there will inevitably be a rising demand among AD plant operators for biomethane selling prices.

Which is why producers of biomethane who are able to claim the RTFCs would do well to link their sales contracts to the independent RTFC market prices [RE]fuel provides, so that they ensure they always sell at the market price, even when that price changes over time.

The spreads that [RE]fuel are publishing in their current reports (RTFC-RHI) show the difference in pence per kwh and pence per litre between what an AD plant would receive for their gas if they were to supply into the transport sector vs the heating sector – ie, at current prices, they would get twice as much per unit of gas sold if they supply into transport.

Andrew Goodwin ( [RE]fuel MD) said:

“Energy Census is delighted to be able to offer a RTFC pricing service to help minimise financial risk for the anaerobic digestion and bio-resources industry at this time of growing production. We look forward to serving the industry as it grows to became a highly significant player, providing much needed renewable fuel into the renewable transport market. This market growth is one which with others will help the global community achieve the decarbonisation (CO2 emissions reductions) essential to attaining the UK's climate change targets.”

Visit www.energycensus.com and register for the reports.

Frequently Asked Questions (FAQs)

What is the purpose of the RTFO?

The RTFO is designed to stimulate the use of renewable energy in road transport, helping the UK meet its decarbonisation and climate change commitments.

How do RTFCs influence the biomethane market?

RTFCs act as financial incentives for biomethane producers, making it more lucrative to sell into the bio-fuels market. Their tradeable nature, however, also introduces price volatility that producers need to navigate.

Why is biomethane seen as the key to the UK's renewable energy ambitions in transport?

Biomethane, derived from biogas, offers a tested and scalable solution to meet the UK's renewable energy targets. It stands as the most efficient use of biogas, reducing transmission losses and providing substantial energy quickly.

Disclaimer:

All views expressed herein regarding market conditions and future trends while based upon an informed interpretation of existing information are likely to be subject to change and may go up or down. It is the readers responsibility to make their own informed decisions and no liability is accepted for any loss incurred from the content herein, or content referred to, or linked to herein.

[Article first posted on 6 January 2018. Updated August 2023.]

![New [RE]fuel RTFC Pricing Service from Energy Census](https://anaerobic-digestion.com/wp-content/uploads/2018/01/New-RTFC-Pricing-Service-1920wCover-786x442.jpg)

Interesting post. I have been looking to find out about how RTFC’s can be applied to biogas plant energy producers.

For the first time I now think I have understood the basics. Many thanks.

I heard that it won’t be long before the new RTFO scheme becomes a reality, and that it has cleared a final hurdle, with House of Lords approval.

Now that is good information. We can tell that a lot of time and effort went towards this post. More people should be made aware of these prices RTFO. This is awesome. Wish it was the same here.

Only wanna admit that this is handy. Thanks – but the RTFO concept is hard to understand.

Can someone tell us how prices will fare after Brexit. Nobody seems to be talking about this surely enormously important change?

Price is going up. This true? Does RTFO Biomethane Price Information include future trends. A crystal ball? That’s what is needed.